south dakota property tax records

Tax amount varies by county. In addition all taxes under 50 are due and payable in full on or before April 30 th.

To 5 pm Monday - Friday.

. January - Real Esate Tax Notices and Special Assessment Notices are mailed to property owners. RecordEASE allows you to search records by legal description tract index grantorgrantee names and document types. If you are unable to visit our office a last document search request may be made by email or phone and will be conducted as time permits.

Please notate ID wishing to pay. Use our free South Dakota property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. Our property records tool can return a variety of information about your property that affect your property tax.

Tax records show the record of taxes on the property. With this article you will learn important knowledge about South Dakota property taxes and get a better understanding of things to consider when it is time to pay. April 1 - Assessment Freeze Applications for the elderly and disabled must be filed on an annual basis on or before this date.

Convenience fees 235 and will appear on your credit card statement as a separate charge. Look Up Any Address in South Dakota for a Records Report. Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions.

Like other states South Dakota has three main types of property records. Special assessments such as Road District fees are due by April 30 th also. Click here for the latest information on motor vehicle titling and registration.

Property Taxes The purpose of this document is to provide a general overview of how property taxes are established. Any person may review the property assessment of any property in South Dakota. Counties in South Dakota collect an average of 128 of a propertys assesed fair market value as property tax per year.

Please call the Treasurers Office at 605 367-4211. First half property taxes are due by April 30 th. Property taxes are DUE by April 30th.

Whether you are presently a resident just contemplating taking up residence in South Dakota or planning on investing in its property find out how local property taxes work. For more details about the property tax rates in any of South Dakotas counties choose the county from the interactive map or the list below. The Property Tax Division plays a critical role in ensuring that property.

To view all county data on one page see South Dakota property tax by county. April 30 - Special Assessments are a current year tax that is due in full on or. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County.

Dakota County Property Taxation Records Attn. Second half are due by October 31 st. A South Dakota Property Records Search locates real estate documents related to property in SD.

Renew Your Vehicle Registrations Online. To protect your privacy this site uses a security certificate for secure and confidential communications. A few South Dakota County Assessor offices offer an online searchable database.

See Results in Minutes. About Assessor and Property Tax Records in South Dakota. Ad Uncover an In-Depth Array of Information on Any Property Nationwide.

Land and land improvements are considered real property while mobile property is classified as personal property. The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. Tax notices are mailed by mid-February.

The Pennington County Equalization Department maintains an onlinesystem wherethe public can review property assessments and property information. If your taxes are delinquent you will not be able to pay online. South Dakota Property Tax Payments Annual South Dakota United States.

The information contained in this fact sheet is current as of the date of publication. South Dakota is ranked number twenty seven out of the fifty states in order of the average amount of property taxes. An individual will receive instructions and assistance on the Index books.

Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property. Tax records deed records and land records. Payment is required at time of service.

The fee for the search is 2000 plus a fee for copies whether emailed or hard copy. RecordEASE Subscriber Administrator 1590 Highway 55 Hastings MN 55033. April 30 - First Half of Real Estate Taxes are due on or before this date.

Property owners may review the information that the county office has on. Median Property Taxes No Mortgage 1786. All special assessments are due in full on or before April 30.

The Property Tax Division is responsible for overseeing South Dakotas property tax system including property tax assessments property tax levies and all property tax laws. Uncover Available Property Tax Data By Searching Any Address. Up to 38 cash back Property Records.

Taxes in South Dakota are due and payable the first of January however the first half of property tax payments are accepted until April 30 without penalty. They need to be recieved in the Davison County Treasurers office by Friday April 29th or postmarked by April 30th. March 2022 The State of South Dakota does not collect or spend any property tax dollars.

It is not intended to answer all questions that may arise. Property assessments are public information. Payments can be mailed to Pennington County Treasurer PO Box 6160 Rapid City SD 57709.

If you would like to pay your Property Tax by credit card we accept Discover Visa and Mastercard. ViewPay Property Taxes Online. You can view the first available images of documents in TIFF format and track escrow balances.

South Dakota real and personal property tax records are managed by the County Assessor office in each county. The second half of property tax payments will be accepted until October 31 without penalty. Please bring your tax payment coupons with you or include them if you mail.

Each type of record contains different information. Property taxes are the primary source of funding for schools counties municipalities and other units of local government. Median Property Taxes Mortgage 2310.

Are Townships A Waste Of Tax Dollars Metro East Leader Weighs In In 2022 Township Lakeville North South Dakota State

Property Tax South Dakota Department Of Revenue

Property Tax South Dakota Department Of Revenue

Property Tax South Dakota Department Of Revenue

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Federal Income Tax Income

Cash Flow Management Kahler Financial Cash Flow Finance Medical Records

South Dakota Sales Tax Small Business Guide Truic

Form 1099 Misc 2018 Credit Card Services Electronic Forms Form

North Dakota United States Genealogy Genealogy South Dakota County Map Dakota County

Property Tax South Dakota Department Of Revenue

Affordable Housing Study Identifies Great Need Possible Solutions For Fredericksburg Region Loc Multifamily Property Management Affordable Housing Solutions

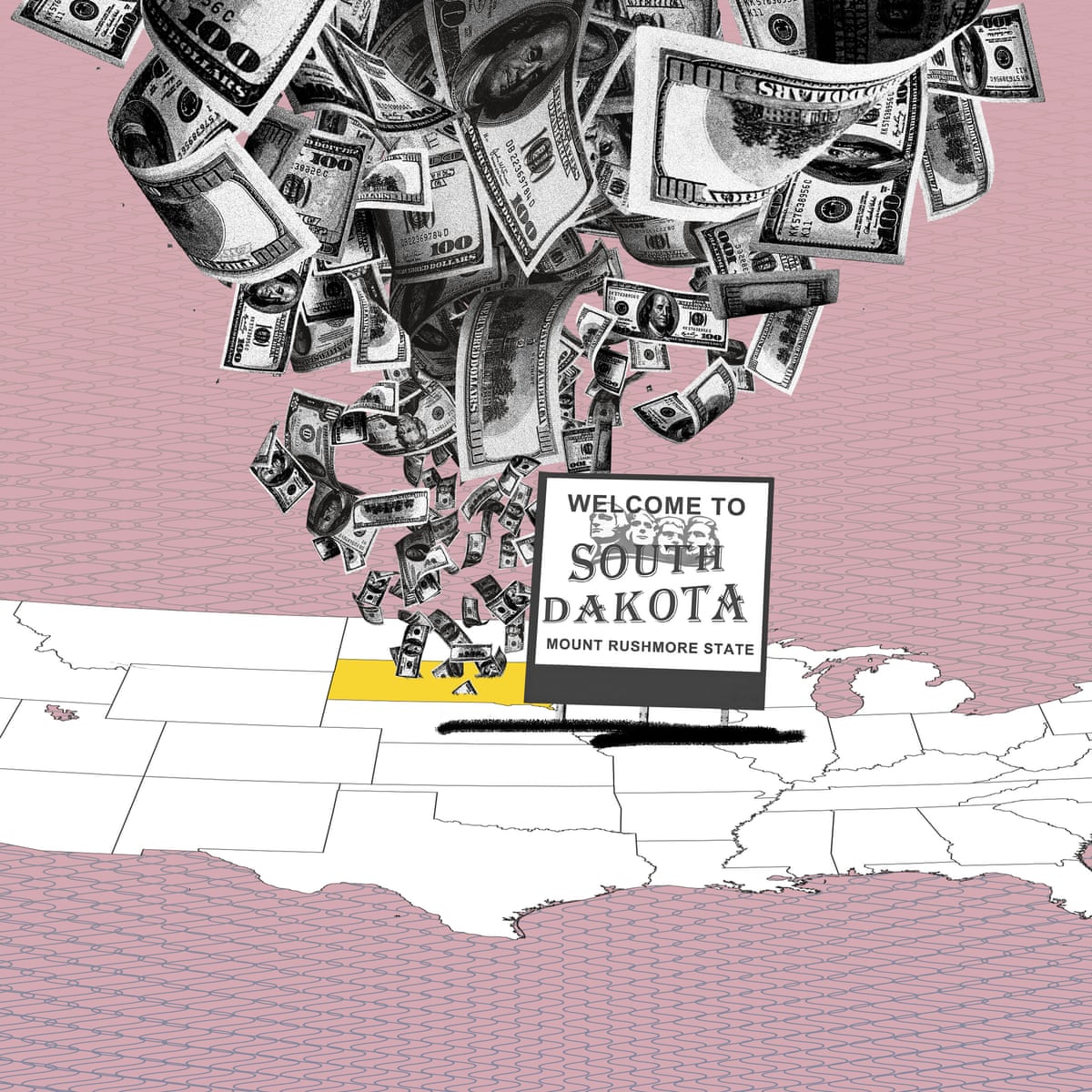

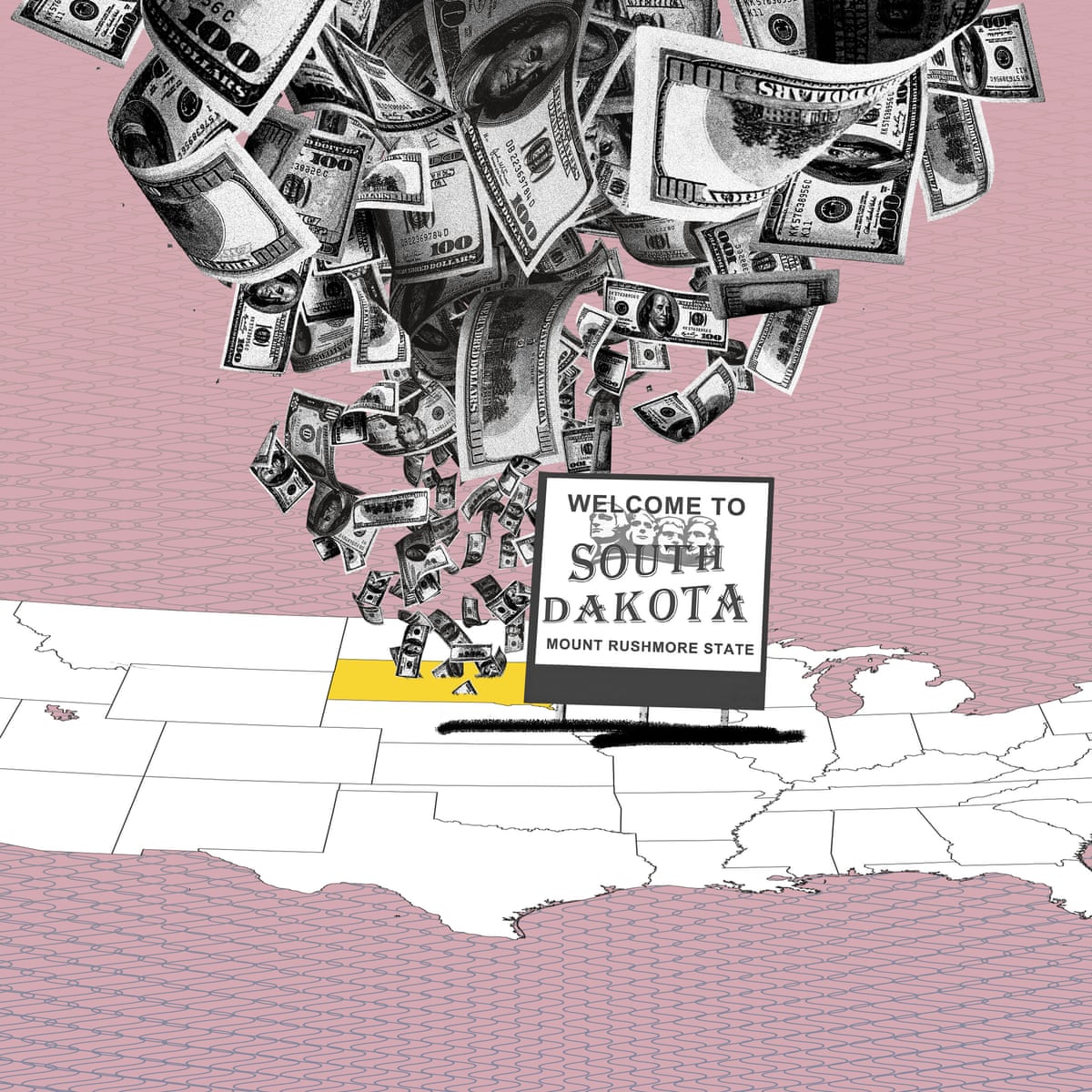

Financial Trusts And Secrecy In The U S Tax Haven Of South Dakota Watch An Excerpt From Frontline And Icij S New P Tax Haven South Dakota South Dakota State

Unequal Funding Public School School District Ny Times

Https Blog Independent Org 2018 10 15 How Does Your State Rank On Individual Taxes Fbclid Iwar3t Jph51w0icagjtlhpg0crgydekbm7 Business Tax Business Climates

South Dakota Public Records Directory Official Documents Directory

South Dakota Property Tax Calculator Smartasset

Pandora Papers Reveal South Dakota S Role As 367bn Tax Haven Us News The Guardian